Nouriel Roubini, chief executive of Roubini Macro Associates, is sticking to his prediction that the coming economic recession will be a severe one, despite a slew of economists saying the financial crisis will be mild.

"There are many reasons why we are going to have a severe recession and a severe debt and financial crisis ... The idea that this is going to be short and shallow is totally delusional," Roubini told Bloomberg News.

Stagflationary Debt Crisis

Roubini, who had famously predicted the great financial crisis of 2008-09, had made it clear earlier this year that the global economy was headed for severe crisis. He says that unprecedented debt levels and rising inflation has created a 'stagflationary debt crisis'.

"In the 1970s, we had stagflation, but no massive debt crises, because debt levels were low. After 2008, we had a debt crisis, followed by low inflation or deflation, because the credit crunch had generated a negative demand shock ... Today, we face supply shocks in a context of much higher debt levels, implying that we are heading for a combination of 1970s-style stagflation and 2008-style debt crises – that is, a stagflationary debt crisis," Roubini said.

Stagflation happens when slow economic growth is combined with high unemployment. In other words, it is economic stagnation worsened by rising prices. According to Investoopedia, stagflation refers to an economy that is experiencing a simultaneous increase in inflation and stagnation of economic output.

Roubini has explained what is meant by stagflationary debt crisis. He is convinced that the next recession will be marked by a severe stagflationary debt crisis. Private and public debt levels are much higher today as a share of global GDP. The debt levels have risen from 200 percent in 1999 to 350 percent currently. The pandemic in partial caused the surge in the global debt levels. "Under these conditions, rapid normalization of monetary policy and rising interest rates will drive highly leveraged zombie households, companies, financial institutions, and governments into bankruptcy and default," Roubini says.

'We Are Getting Close'

In June, Roubini said that a recession will set in by the end of the year. "We're getting very close," he said, adding that consumer confidence was dipping even as sectors like retail sales, manufacturing and housing were slowing down.

Roubini's latest warning comes ahead of a policy meeting of the US Federal Reserve. The US central bank is expected to raise rates by 75 basis points this week. With inflation remaining rampant, the Fed will tighten rates further this year, with economists expecting a total interest hike of 350 basis points for the entire calendar year.

However, US Treasury Secretary Janet Yellen has admitted that US economic growth is slowing but insisted that a recession was not inevitable. According to Yellen, strong U.S. hiring numbers and consumer spending showed the U.S. economy is not currently in recession.

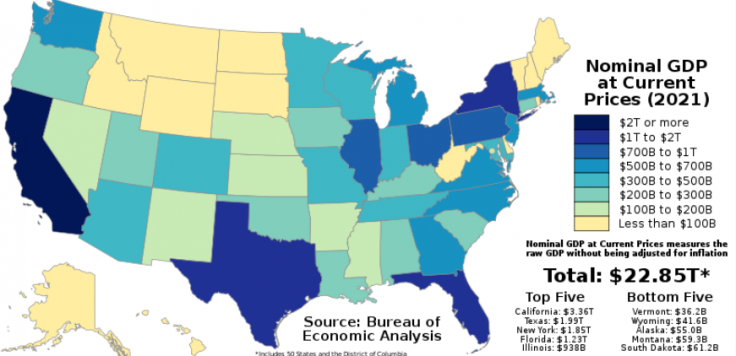

Data showed last month that the US economy contracted in the first quarter at a faster rate than anticipated earlier. The world's largest economy shrank at an annual rate of 1.6 percent in the first quarter, according to the Commerce Department.

The contraction was more than the 1.5% previously reported. According to the advance estimate released in April, the GDP decline was 1.4 percent while the second estimate showed the drop would be 1.5 percent.