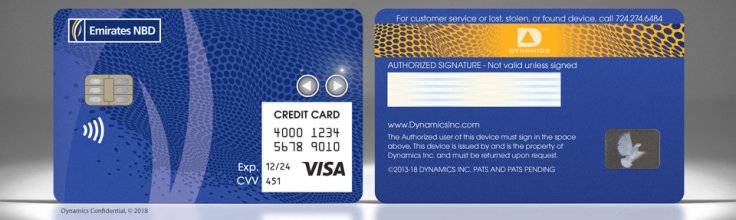

In the wake of the growing popularity of cashless transactions, digital payments firms Visa and Dynamics Inc have come together to produce the Wallet Card, the world's first-ever multipurpose card in the same size and shape as the regular credit and debit card. The integration of new features and cutting-edge technologies is what makes this Visa-branded card unique.

Launched on Tuesday at the Consumer Electronics Show in Las Vegas, the Wallet Card acts not only as a credit and debit card but as prepaid, multicurrency, one-time use or loyalty card. The card bears a 65,000-pixel screen for display of account information, giving users the ability to switch between cards or accounts in a tap.

Also read: Moen's new smart shower adjusts temperature using Alexa or Siri

Wallet Card is embedded with a cellular chip and antenna used in smartphones, enabling it to transfer data between the card and a user's bank anywhere in the world and at any time of the day.

Visa and Dynamics boast the instant issuance of the card to consumers and its immediate activation. In case of compromised card account numbers, a bank can quickly remove it and replace it with a new number without needing to dispose of the card.

Also read: iDevice Instinct smart light switch makes your wall talk, thanks Alexa

In addition, the card is capable of receiving alerts and messages any time after, for instance, a purchase or suspicious withdrawal is made. In case of the latter, users will be able to report the incident and notify the bank in no time. Finally, its organic chip enables its battery to self-charge, a feature that would make the entire digital card system convenient to use.

"Innovation in the payments category is not limited to wearables, cars, security or mobile technology – there is still much that can be done to update the card-based experience, which continues to be the primary form factor used globally to complete digital payments transactions," says Mark Nelsen, senior vice president of risk and authentication products at Visa.

Wallet Card will be available within the year to financial institutions for testing.