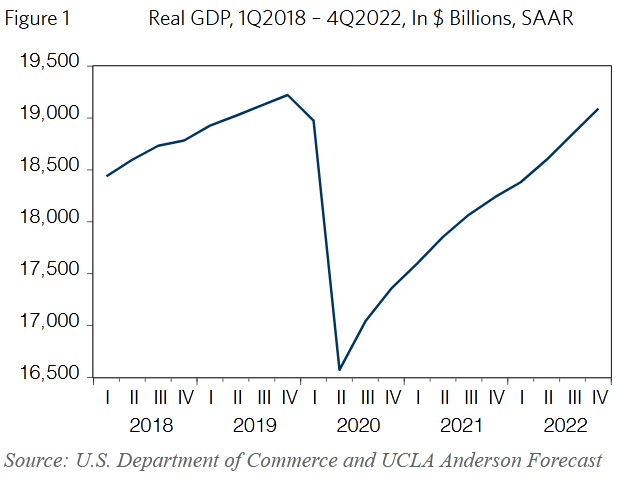

The coronavirus pandemic has pushed America to an economic depression, according to a study by UCLA's Anderson School of Management. It further says that recovery won't be seen until 2023.

The study was published by a research firm at the UCLA Anderson School's Forecast by David Shulman as a part of its quarterly outlook on the US economy. Further, the UCLA forecast - June 2020 said that the GDP will not be returning to pre-pandemic levels until early 2023.

Referring to the crisis, the report quoted the leader of 1917's Russian revolution Vladimir Lenin -- "There are decades where nothing happens, and there are weeks where decades happen."

Recession a Misnomer

Schulman wrote that calling the present crisis a "recession" is a misnomer. "Make no mistake, the public health crisis of the pandemic morphed into a depression-like crisis in the economy."

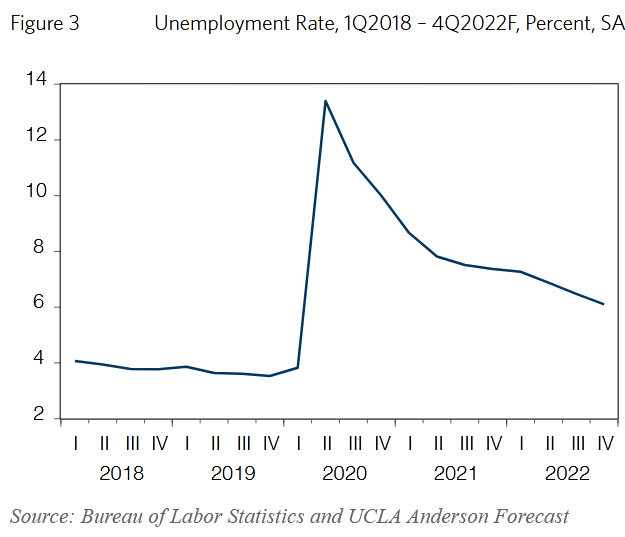

Despite a drastic response by the Trump Administration and the Federal Reserve, getting back to pre-pandemic levels of employment in the US will take years together, said the report.

"Simply put, despite the Paycheck Protection Program too many small businesses will fail and millions of jobs in restaurants and personal service firms will disappear in the short-run," reads the report.

What if a Vaccine is Available?

Even with the availability of a potential coronavirus vaccine, it is set to take much time for the economy to return to normal, says the report citing 9/11. It took over two years for the air travel to return to its previous peak. Now, as the businesses are taking a huge debt, its repayment will remain a top priority over spending new capital.

"And do not forget that state and local budgets suffered a revenue collapse that even with federal assistance it will take years to recover from," said the report, adding that America lost 22 million non-farming jobs in the initial months of the COVID-19 pandemic.

However, it highlights at least one positive thing about the housing market. Despite high unemployment rates, "consumer demand remains strong" for housing markets and will return to pre-pandemic levels soon, the report says.

Rising Trends

The report also estimates that there will be an acceleration of some pre-existing trends such as the growth of online retail, telecommuting, and also the rising tensions between the US and China.

"A Major response to the pandemic has been the success of work from home which looks like it will lead to long term changes in work and urban environments as workers avail themselves of more work/life options," concludes the report.

"In a nutshell economic and housing activity will shift from large cites to mid-sized cities and away from the urban centers to the suburbs."