Ray Dalio's Principles: Life and Work is a popular guide for investors to manage investment returns and risks through a systematic, data-driven application of portfolio diversification. The Catalyst Systematic Alpha Fund (ATRFX) is a publicly traded mutual fund that applies Dalio's unique philosophy to quantitative analysis, risk management, and portfolio optimization. Unsurprisingly, the fund has ranked in the top 1% of Multistrategy funds in Total Return over the past 5 years. This earned the fund the 2023 award for Best Fund over 5 Years from Refinitiv Lipper in the Absolute Return Category

By integrating these principles into its investment process, the Catalyst Systematic Alpha Fund aims to achieve consistent and sustainable returns for its investors. In this article, we will explore how Ray Dalio's Principles apply in the management of the Catalyst Systematic Alpha Fund and the impact they have had on the fund's performance.

The Flaw of Traditional Investment Management

Traditional investment strategies and philosophies are under assault. Fixed-income investors are suffering market losses with rising interest rates, while the S&P 500 fell 18% in the past calendar year. Technology stocks, the darlings of past bull markets, are laying off hundreds of thousands of employees. The national bank most associated with venture capital - Silicon Valley Bank collapsed in March.

History tells us that bad times inevitably end, eventually forgotten in the euphoria of optimism. The cycle of bull and bear markets continuously repeats. David Gardner, a co-founder of the Motley Fool investment adviser, notes. "Stocks go down faster than they go up but go up more than they go down."

We often overlook that a subsequent rise in value after a fall must double the decline's value. A $1000 investment that loses half of its value ($500) ($500/$1000 = 50% decline) must go up 100% ($500/$500 = 100% increase) to get back to its former value. This consequence may be why Buffett reputedly advised, "Rule No.1: Never lose money. Rule No. 2: Never forget rule No.

1." The dilemma for investors is whether to invest and hold with the inevitable consequences of market losses or continuously sell to avoid losses while trying to reinvest in companies whose values will increase.

"It's Not What You Earn but What You Keep"

Dalio's investment philosophy recognizes that market moves are generally "surprises," instances where the impact of an event exceeds expectations. Dalio believed amalgamating defensive and aggressive investment positions would best insulate the portfolio from surprises.

Dalio aims to structure portfolios with uncorrelated investment returns based on risk allocations rather than asset allocations. An ideal portfolio would simultaneously limit losses in bear markets and deliver above-average returns in bull markets. He proposed diversified portfolios that included a variety of stocks, bonds, commodities, derivatives, and cash. His company, Bridgewater, developed four different portfolios, each with the same risk, each of which does well in a particular environment: when (1) inflation rises, (2) inflation falls, (3) growth rises, and (4) growth falls relative to expectations.

Catalyst Systematic Alpha Fund (ATRFX)

The last three years have been excruciating for many investors due to the series of calamities that occurred. Many economists have warned of a financial crisis as the failure of the giant Silicon Valley Bank reverberates through the banking industry. The bad news follows an earlier report that 63% of economists polled by the Wall Street Journal forecast a national recession in the next twelve months.

Funds like the Catalyst Systematic Alpha Fund function best in uncertain economic environments. The ATRFX managers partnered with BNP Paribas, a leading European bank, to create a fund managed with Dalio's investment principles. The fund's investment objective is to manage a portfolio of assets with attractive risk-adjusted returns with sufficient diversification so that no single asset or class dominates the portfolio's risk profile. Its portfolio managers continually monitor the fund's exposure to potential loss and adjust its holdings to remain consistent with its objective.

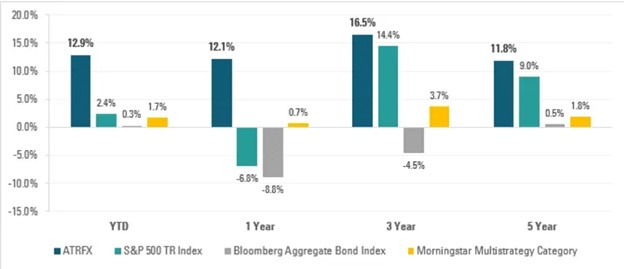

Yahoo Finance calculates a 3-year beta of 0.58 and an Alpha of 8.74. The fund is categorized as "multistrategy" by Morningstar with a beta of 0.54 as of February 28, 2023. The Chicago-based investment research firm is considered the premier rating service for mutual funds. The company has assigned 5-Star ratings to ATRFX for its past 3 and 5-year performance.

The BNP index that ATRFX tracks has experienced minimal investment loss its managed aggregation of diverse assets classes balancing volatility and momentum can deliver above-average results with below-average risk.