Last week's long-awaited release of the SEC's report on January's GameStop saga highlighted the role of payment-for-order-flow (PFOF) in the 'gamification' of day trading, but stopped short of banning the practice outright.

Payment-for-order-flow is central to the rise of the commission-free trading apps which have allowed trading by retail investors to boom in recent months.

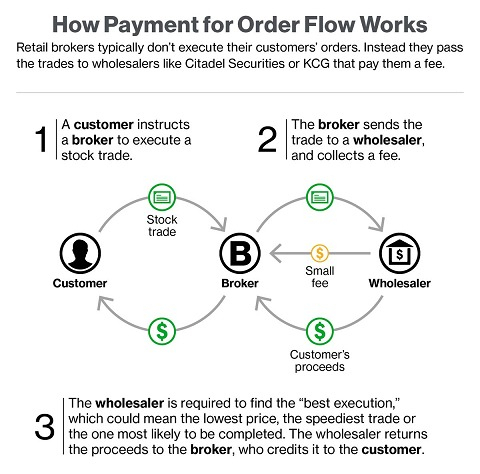

The practice enables brokerages like Robinhood to sell customers' buy and sell orders to wholesalers, such as Citadel. So brokers generate revenue by offering zero-commission trading to retail investors when commissions are in fact being subsidized by wholesalers.

For many of us in the trading industry, a frank discussion about PFOF had felt long overdue, making the report's indecision over the future of the practices feel a little like the can is simply being kicked down the road.

The practice is outdated and counter-productive to market efficiency, especially in today's climate. There is also a strong case to be made that terminating PFOF could result in significant collateral benefits for all investors beyond simply addressing the current issue.

To see why requires an understanding of the origins of the practice. Many years ago, old-fashioned floor traders demanded that a one cent spread be mandated to cover their risks in providing market-making services. However, today's markets primarily use computers to provide liquidity on over 80% of the daily trading volumes. Unfortunately, regulators have not kept pace with this evolution.

So PFOF continues to flourish because regulators have mandated trading occur at minimum trading increments that are substantially wider than markets now require. In a perfect world, bids and offers would be at the same price, with only access costs to consider.

As a result, wholesalers pay online brokers to redirect client business off the market where retail orders are held and matched, enabling the directing brokers and wholesalers to pocket the difference for themselves. What seems like pennies can translate into the billions of dollars lost each year by the retail clients whose buy and sell orders were so misdirected from the open marketplace and thus artificially mispriced.

These covert commissions are what enable many online brokers to cover costs and make their profits. That is how they offer their services "for free". At a macro level, having most of the retail or "natural" order flow channeled off to these discreet arrangements means that the actual public markets are often deprived of more than 30% of the order flow that would have otherwise contributed to the very price discovery mechanism upon which the integrity of the entire trading system is predicated.

The same anachronistic regulation is why inverted markets have arisen over the last few years. All order flow, not just retail, is susceptible to these markets. The truth is that - in today's markets - there are already sufficient players willing to provide liquidity at the actual real market price without needing the benefit of this hidden tax.

The good news is that an elegant and immediate solution is now at hand. Simply eliminate the concept of a minimum trading increment. Let investors have access to the better pricing of a perfect market. Access fees will thus become transparent once again and so properly factored into trading decisions. Retail order flow will be returned to the public market, to the benefit of all participants.

All investors would reap the full efficiencies of the market and correspondingly pay the true cost of facilitating trades. In turn, the fact of incurring this cost would likely deter small retail investors from indulging in risky gamification, and a more sustainable equilibrium might be reached in the long-term.

Quite simply, the reliance on PFOF to surreptitiously finance the illusion of free trading requires examination. When something is free, human nature tends to undervalue it. What many retail investors appear to have failed to realize is that free trading is possible only because they themselves have become the product.

Daniel Schlaepfer is the President and CEO of Select Vantage Inc. (SVI), a global market-making firm.