The Singapore police have warned the public about a rise in investment scams involving the misuse of shell investment applications, with losses amounting to at least S$1.7 million since October 2025. At least 20 such cases have been reported, the authorities said.

In this scam variant, victims are first drawn in by social media advertisements promoting so-called investment products that promise high and quick returns.

After clicking on these advertisements, victims are contacted by scammers via WhatsApp and added to group chats with impressive-sounding names such as "Interactive Elite Knowledge Academy" or "168 Wealth Pursuit".

Within these chat groups, victims encounter individuals who claim to be successful investors and who actively endorse the legitimacy of the investment opportunities and their supposed returns.

The police said that these individuals are believed to be part of the scam syndicate, working together to gain the victims' trust and persuade them to invest.

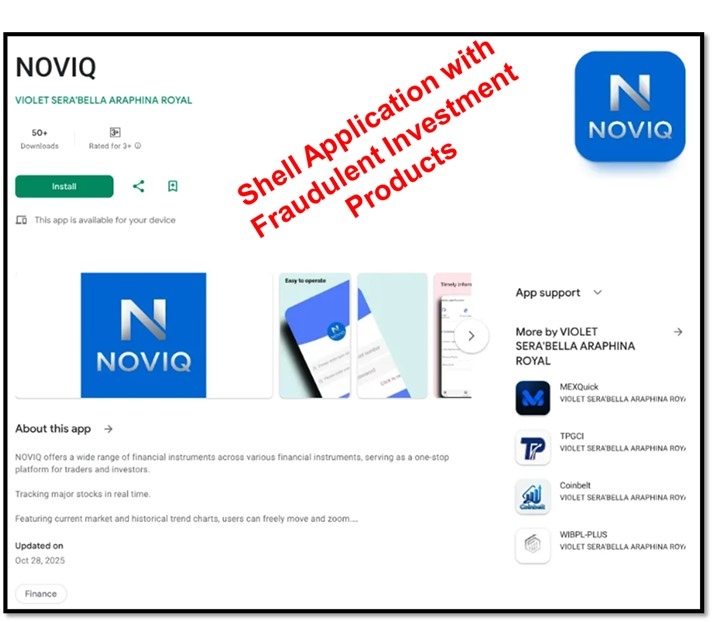

Once convinced, victims are instructed to open trading accounts by downloading applications from official app platforms such as the Apple App Store or Google Play Store.

Examples of such applications include FPTUP, FPTEX, NOVIQ, FPCAP, SDXA, SJ NEXUS, WHG ROUP and GINKO PLUS. Although these apps appear legitimate, the police said they are shell investment applications used to promote fraudulent cryptocurrency, foreign exchange and stock-trading products. Any trades or profits shown within the apps are fabricated and do not reflect real investments.

The victims are then asked to transfer money to designated bank accounts or make payments via QR codes linked to services such as YouTrip to begin their "investments".

In some cases, scammers go further by asking victims to meet unknown individuals in person to hand over cash or gold. Victims may be given documents as proof of deposit, which falsely claim to be linked to investment entities that are not licensed by the Monetary Authority of Singapore to provide financial services.

Many victims only realise they have been scammed when they are unable to withdraw their money or access the purported profits.

The police have urged members of the public to exercise caution when approached with investment opportunities, particularly those that require the downloading of unfamiliar applications.

They also warned against agreeing to meet unknown persons to hand over money or valuables and advised the public never to transfer funds to individuals they do not know or trust.