Russia left its benchmark interest rate unchanged at Friday's policy meeting and said that the rate is unlikely to be cut anytime soon given the decreasing inflationary pressures and rising growth recovery hopes.

The apex bank said the country will near its 4% inflation target by the end of 2017, and the annual GDP rate is expected to get back to the positive zone this year itself.

The Central Bank of Russia held the benchmark one-week repo rate at 10%. It was last cut by 50 basis points on September 16 when the apex bank said it may cut further reduce rates in the first half of 2017 given growth challenges.

"Maintenance of moderately tight monetary conditions will constrain inflation risks, including the short-term ones, coming from the launch of purchase of foreign currency in the FX market," the CBR said.

According to the central bank, inflation performance has been in line with the forecast, inflation expectations were going down gradually, and the economy was recovering faster than previously expected.

"The Bank of Russia's forecast suggests that given today's decision and extension of moderately tight monetary policy, annual inflation is to slow down to the 4% target by late 2017 and hold close to this level in the sequel," Friday's policy statement said.

"The Bank of Russia estimates that quarterly GDP growth rates entered positive territory in the second half of 2016, with the positive trend set to hold into the first quarter of the current year," the bank said on Friday.

Inflation, GDP and GDP

As per the 10 Jan data, consumer price inflation has fallen to a 4-1/2-year low in Russia. The December rate was 5.4% year-on-year, its lowest since June 2012, and down from 5.8% in the previous month.

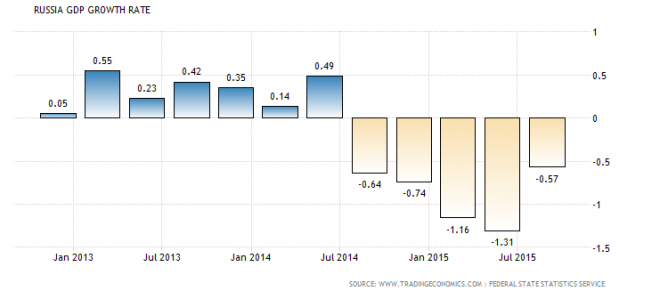

The Russian economy shrank 0.4% year-on-year in the third quarter of 2016, following 0.6% fall in the previous period, and in line with preliminary estimates, data showed on 13 December.

It was the smallest contraction in seven quarters, driven by lower drop in construction, public administration, transport and accelerated growth for mining and quarrying and agriculture, and indicating the stabilising growth scenario.

Russia has been recording negative growth rates since January 2015 and the reason for getting stuck in recession are low oil prices and sanctions over Ukraine that closed access to capital markets.

Despite international sanctions, Russia's trade surplus increased unexpectedly by 2.2% to $9.14 billion in November from $8.94 billion in the same month a year earlier, beating market expectations of a $7.6 billion surplus. The health of the trade scenario was also indicative of the strength of economic recovery in the country.

Rouble

The Russian currency has been strengthening over the past several weeks, reflecting the rising confidence about the economic performance of the country.

The Russian rouble traded in a tight range of 59.63-59.05 per US dollar on Friday, holding near the 18-month high of 58.54 hit intraday on Thursday. The Russian unit has been rising since December and in the two months through January, it had gained more than 8%.

Having broken below the support at 60.80, the USD/RUB pair now targets 57.30, the 50% Fibonacci retrace of the 4-year rally to the 2016 peak of 85.0. The next level is 55.0 but a more important one will be 50.0, the 38.2% retrace.

On the higher side, the 62.0-67.0 zone will be a strong resistance band ahead of critical levels like 70.0 or above.