In the world of High Finance, particularly within the domain of buy-side firms (hedge funds, family offices, private equity, proprietary trading firms, etc), the path to success is often seen as a labyrinthine journey reserved for a privileged few. This perception is fueled by the reliance on closed Ivy League networks and personal connections, which make it seem like an impenetrable fortress. Yet, the financial industry's allure, with its high compensation packages, consistently draws hundreds of thousands of ambitious candidates each year, each eager to break into this exclusive club. However, for most, overcoming the formidable barriers to entry remains beyond reach.

One distinctive challenge lies in the recruitment processes of small and medium-sized hedge funds and family offices, which, unlike their larger counterparts, often lack a formal HR infrastructure. Instead, they tend to heavily rely on word-of-mouth referrals or engage the services of recruiters to identify potential talent. These closed networks and referrals often deter newcomers and further propagate the notion that high finance is for the privileged few. But two visionary voices in the industry are challenging these age-old norms.

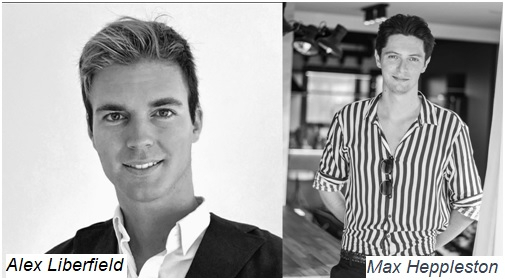

Max Heppleston, a partner at a prominent alternative asset management search firm and an advisor at TrendUp offers an insightful perspective. He argues that while professional recruiters are often the way to go for mid to senior positions, they may not be the ideal choice for entry-level/graduate roles.

Some firms opt for college career fairs and a small number have even developed graduate programs as a means to discover promising young talent, however, this approach, he argues, has its limitations; primarily an overreliance on a limited set of quantitative metrics. It also relies on potential candidates already being in a select few top schools and programs, which can lead to missing a large part of an incredibly talented pool that simply may not have been able to attend. To Heppleston, TrendUp Now helps level the playing field and broadens the talent pool for investment firms to truly find the top talent that is out there, not just the best of a select few.

Revolutionizing Talent Recruitment: The TrendUp Now Program

Challenging the conventions of traditional recruitment methods in the investment finance sector is Alex Liberfield, managing partner at Liberfield Capital, a hedge fund, and TrendUp's CEO. He advocates for a paradigm shift in identifying and nurturing talent. Liberfield's proposal is simple yet groundbreaking: to directly connect bright candidates with employers, provide them with comprehensive training in investment strategy, and rigorously evaluate their performance.

This visionary approach forms the foundation of the TrendUp Now program. Rather than relying solely on academic pedigree or subjective recommendations, the program identifies individuals with a genuine interest in investment finance and puts them through a rigorous training regimen. However, the program goes further by measuring their actual performance in a real-world environment, giving them a true taste of the industry. The top performers are not only recognized but are also granted coveted internships within the investment space, along with invaluable recruitment guidance. In conversations with TrendUp alumni, we see that many have been able to secure top hedge fund internships and full-time High Finance roles this way.

The brilliance of the TrendUp Now program also lies in its inclusivity. Participants are drawn from diverse backgrounds, encompassing motivated upperclassmen in college, seasoned professionals already embedded in the world of finance, or more unorthodox candidates, like engineers eager to pivot into the investment sector. In an industry where diversity of thought is increasingly valued, this inclusive approach not only empowers the candidates but also enriches the industry with a broader range of perspectives and ideas.

So far, conversations with employers suggest the experience of hiring TrendUp graduates has been overwhelmingly positive, emphasizing their impressive knowledge of investment strategy and their ability to hit the ground running. While each firm may have its unique ethos and approach, the solid foundational knowledge streamlines the onboarding process. The adoption of the TrendUp Now program is also yielding substantial cost savings for employers in the finance industry. By sidestepping the traditional recruitment methods that often involve substantial fees, firms can save tens of thousands of dollars. Moreover, the reduced reliance on extensive in-house training further contributes to cost savings, allowing firms to allocate resources more efficiently.

Today, the success and cost-efficiency of the TrendUp Now model are driving an increasing number of firms to collaborate with the program, and some of them are actively subsidizing it. Year after year, the network of firms partnering with TrendUp is expanding, a trend expected to grow exponentially: As competition within the finance sector intensifies, companies are seeking ways to enhance their investment divisions while simultaneously trimming administrative costs. The TrendUp Now program offers a practical solution by supplying a pipeline of qualified, trained candidates, thereby strengthening firms' capabilities and bolstering their bottom lines.

By providing comprehensive training, rigorous evaluation, and a commitment to inclusivity, TrendUp Now seems to be redefining the path to entry into high finance. This innovative approach not only equips candidates with the necessary skills and knowledge but also fosters a diverse and dynamic workforce that benefits the entire financial industry. As the landscape of High Finance continues to evolve, initiatives like these may hold the key to democratizing access to this exclusive world and ensuring that talent, not just connections, is the key to success.