India's Prime Minister Narendra Modi has imposed nation-wide ban on existing Rs. 500 and Rs. 1000 notes in a move to eradicate the consequences of illegal black money transactions across the sub-continent. Terrorist funding, arms smuggling and counterfeit currency are among the chief factors that have forced the government's hand to impose such a stringent ban on the higher denominations in Indian currency.

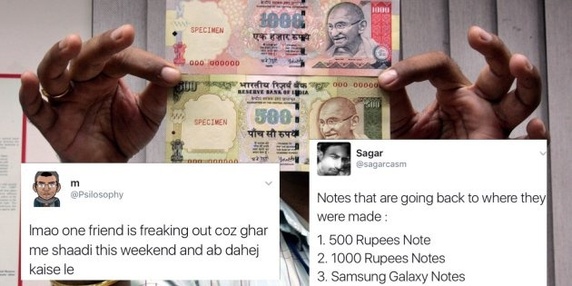

There has been a spate of mixed reactions from the public as well as Modi fans on the social media after the high-profile announcement wherein the move is widely projected to enhance the growth and economy of the country in the coming years.

The illegal hoardings associated with black money has often turned to be a double-edged threat to the economic stability of the country as it often paved the way for excessive tax evasion while also promoting inflation that could cripple further growth and developmental projects in India.

IBTimes SG explores some of those hilarious jokes and comments making waves across various social media networks including Twitter, Facebook, and Quora, in the wake of Modi's fight against corruption:

For more of these funny tweets and jokes, just check out the two incredible twitter handles driven by Modi's spirit: #Rs500andRs1000 and #ModiFightsCorruption

Read more on what Quora members have to say about the recent ban on 500 and 1000 rupee notes in India along with economic and financial analysis from some economic enthusiasts here and here.

Jokes and fun apart, people who are in dire need of details for exchanging their lumps of cash in Rs. 500 and Rs. 1000 denominations can check out the following highlights from the announcement:

- Persons holding old notes of five hundred or one thousand rupees can deposit these notes in their bank or post office accounts from 10th November till close of banking hours on 30th December 2016 without any limit.

- You will have 50 days to deposit your notes and there is no need for panic.

- You can also continue using debit or credit cards or netbanking as you would do normally.

- After depositing your money in your account, you can start drawing up to Rs. 2,000 per day until further notice via your nearest ATM.

- Keeping in mind the supply of new notes, in the first few days, there will be a limit of ten thousand rupees per day and twenty thousand rupees per week on all bank withdrawals. This limit will be increased in the coming days.

- For your immediate needs, you can go to any bank, head post office or sub post office, show your identity proof like Aadhaar card, voter card, ration card, passport, PAN card or other approved proofs, and exchange your old five hundred or thousand rupee notes for new 500 notes.

- From 10th November till 24th November the limit for such exchange will be four thousand rupees. From 25th November till 30th December, the limit will be increased.

- There may be some who, for some reason, are not able to deposit their old five hundred or thousand rupee notes by 30th December 2016. They can go to specified offices of the Reserve Bank of India on or before 31st March 2017 and deposit the notes along with an affidavit or declaration form.

- For 72 hours, till midnight on 11th November, railway ticket booking counters, ticket counters of government buses and airline ticket counters at airports will accept the old notes for purchase of tickets. This is for the benefit of those who may be travelling at this time.

- Until midnight (IST) of 11 November, five hundred and thousand rupee notes may be accepted at the following locations or outlets:

- Petrol, diesel and CNG gas stations authorised by public sector oil companies

- Consumer cooperative stores authorised by State or Central Government

- Milk booths authorised by State governments

- Crematoria and burial grounds.

UPDATE: RBI has denied all social media claims about the presence of Nano GPS chip on the newer 2,000 rupee currency notes. It is now officially confirmed that all such claims are false and just baseless rumours.

How does the Nano GPS chip (NGC) technology work if implemented in future

The Modi government has started rolling out Rs. 2000 currency notes through RBI-affiliated banks, while RBI has denied any implementation of advanced security features like a Nano GPS Chip technology. This could actually become counter-productive for Modi's campaign against corruption and black money.

Here's how the new NGC technology will work if implemented in future:

- The NGC technology embedded in the note will work as a signal reflector without the use of any external power source.

- The NGC can send and receive signals to and fro from the satellite and hence it can transmit precise location coordinates to the sender including the serial number of the note.

- This would help in tracking the notes even at 120 metres below the ground level.

- The satellite can track as well identify the exact amount of money stored in a particular location. If there is a large amount of money kept at a location, then it would send out the signal and this information will be passed to the Income Tax Department.