Collecting fine wine and rare spirits has traditionally required industry knowledge, access to exclusive networks, and a willingness to navigate opaque markets. Purchases were traditionally handled through private brokers or high-end auctions, limiting participation to a narrow group of investors and collectors.

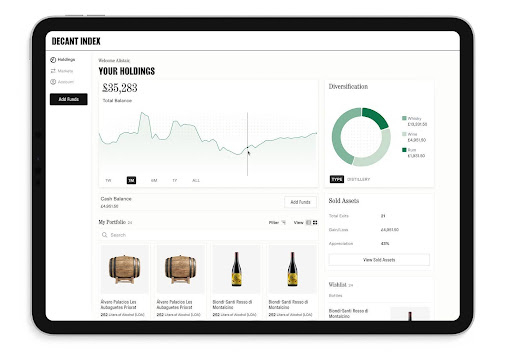

Decant Group is changing that with Decant Index, a digital marketplace that applies the structure of platforms like StockX and Chrono24 to fine wine and spirits. It allows users to treat bottles not just as luxury goods, but as financial assets, trackable, priced based on market data, and secured with professional storage options.

Turning Bottles into Assets

Decant Index presents each bottle as part of a structured portfolio. Pricing is backed by global auction data, critic scores, and market demand, giving users a clear picture of each asset's financial performance. Authentication is built into the platform, ensuring that assets are not only genuine but also suitable for trade.

Buyers are no longer reliant on informal advice or instinct. Instead, they can access performance metrics and valuation tools to guide decisions. This system mirrors that of watch and sneaker marketplaces, where condition, rarity, and price history help buyers assess investment potential.

"Some clients build to drink. Others for profit or legacy," said Alistair Moncrieff, Chief Executive Officer of Decant Group. "Decant Index supports all those paths." The platform caters to a range of investment goals without compromising access or control.

Structured Entry Points

To make the asset class more accessible, Decant Index launched the Wine Cellar Plan. Starting at $330 per month, the plan offers three tiers Bronze Plus, Silver Plus and Gold Plus. Each provides access to carefully selected wines with strong secondary market performance.

Selections include Bordeaux First Growths, Burgundy Grand Crus, Super-Tuscans, and premium labels from Napa and the Rhône. Wines are chosen based on factors like aging potential, scarcity, and past auction results. Gold Plus members receive additional benefits such as dedicated account managers, private tastings, and waived fees.

"Today's investors expect digital infrastructure, liquidity, and transparency," Moncrieff said. "Decant Index was created with those standards in mind." With tiered access and professional guidance, new and experienced investors can participate at their preferred level.

Secure Storage and Transparent Exits

Decant Index is supported by Decant Bond, a bonded warehouse in Alloa, Scotland, launched in June 2024. Bottles stored at the facility benefit from optimal climate conditions and full insurance coverage. Clients receive routine updates through the platform about the condition and value of their holdings.

When investors are ready to sell, they can choose from private sales, marketplace listings, or auction consignment. Every option is documented and backed by verified data. "We have facilitated over 1,618 exits and returned $6.1 million to clients," Moncrieff said.

The end-to-end service sourcing, valuation, storage, and sale gives investors a complete view of their portfolio. It also ensures that the physical integrity of the assets is preserved throughout the ownership cycle.

Expanding into a Broader Asset Class

Wine and spirits are increasingly viewed not only as luxury consumables but as tangible assets within alternative investment portfolios. With Decant Index, those who once collected for personal interest can now do so with greater financial purpose. As market interest grows, so does demand for reliable infrastructure.

The platform's tools appeal to a wide spectrum of users. Some seek long-term growth, others favor near-term liquidity, and some wish to pass down collections. Regardless of intent, the company offers a framework that supports measurable outcomes and secure ownership.

"Luxury is changing. It is no longer just about ownership it is about engagement, access, and performance," said Moncrieff. This shift, reflected across multiple sectors, is shaping how younger and more data-conscious investors approach physical assets.

Looking Beyond Traditional Boundaries

Decant Index plans to expand further, bringing categories such as premium rum and American bourbon into its offering. These spirits have gained attention among collectors and investors, adding new dimensions to portfolios traditionally centered on wine and Scotch whisky.

What sets the platform apart is its balance of usability and infrastructure. It brings transparency and data to a market that often lacks both. By offering secure storage, structured valuation, and accessible investment plans, Decant Index is not just selling products it is establishing a market standard.

"Decant Index is not just about making investing easier," Moncrieff said. "It is about making a historically exclusive asset class visible, accountable, and investment-ready." As more collectors seek out platforms that offer both control and credibility, Decant Index is well-positioned to lead that shift.

Decant Group's New E-commerce Platform: House of Decant

Decant Group is preparing to launch House of Decant, an e-commerce channel for collectable bottles. The online store will offer premium selections, fast delivery, and concierge-style customer service. It is designed to complement the firm's investment platform while also reaching a broader audience.

Chris Seddon, managing director at Decant Group, said the company is focused on adapting to evolving consumer expectations. "We are building a platform that changes how premium wine and spirits are discovered, purchased and enjoyed designed for what today's luxury consumer expects."

Learn more about what House of Decant has to offer here.