Natural gas prices in Europe soared in the aftermath of the Russian supply curbs following the Ukraine invasion, causing a surge in inflation and bringing on the possibility of recession. The prices remain elevated as countries are trying to ferry natural gas in their regasification efforts before the onset of the winter.

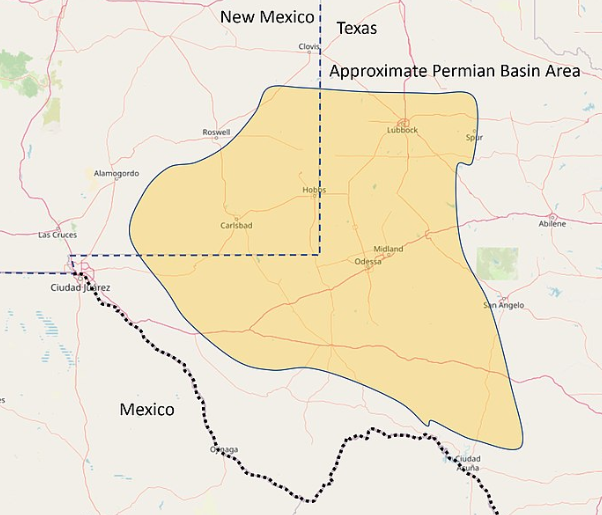

However, in sharp contrast to this scenario, gas prices are declining rapidly in another corner of Earth. Reports say that natural gas prices in the Permian Basin of West Texas are approaching zero and there is a possibility that well operators are staring at the possibility of having to pay for gas to be lifted off their networks.

Bloomberg reported that gas produced in the Waha region of the Permian Basin are selling for as little as 20 cents to 70 cents per million British thermal units. This is in stark contrast with the European natural gas prices that are hovering around $28. Even within the US, the benchmark futures contract is at around $5.20.

What are the Reasons?

The main reason behind the price decline is the growing glut amid booming output. According to the US Energy Information Administration, production in the Permian Basin is projected to increase further.

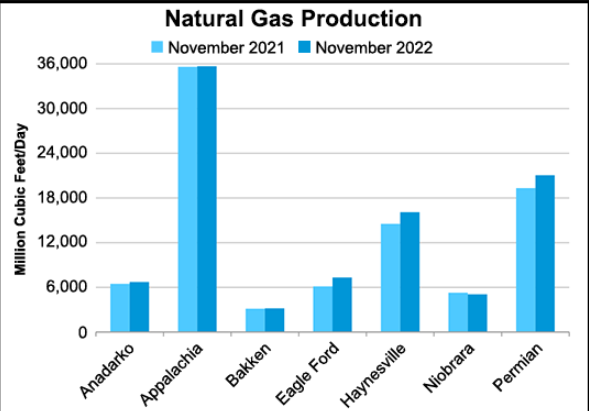

According to Energy Indepth, the output in the Permian Basin is forecast to hit record high in November 2022. The report notes that the Permian Basin has the potential to substantially increase oil and natural gas output in the years to come.

The second reason is the constraints in the pipeline networks. According to Bloomberg, the latest price crash in Texas was caused by a supply glut that resulted from the closure of key networks due to maintenance work. While the price volatility hampered energy companies' ability to invest in pipelines, regulatory issues and resistance from environmental groups have also had negative impact on pipeline capacity building.

Booming Output

According to S&P, price weakness at Waha region of the Permian Basin started in September when gas production rose to the mid-15 Bcf/d range.

The US Energy Information Administration says that elevated natural gas prices in the US had driven production in the largest resource basins. "Texas and Pennsylvania have driven this increase; production grew by nearly 1.5 billion cubic feet per day (Bcf/d) in both states between 2020 and 2021. Texas overlays the Permian Basin and Haynesville Basin, which were both major sources of production growth in 2021. Similarly, Pennsylvania overlays the Appalachian Basin, which now accounts for nearly one-third of all U.S. dry natural gas production," the agency says.