With jobs at stake and unemployment on the rise, people are falling back on personal loans more than ever to support their finances. According to data from Loanry, the number of people with personal loan debt totaling more than $30,000 has risen by 15 percent in the past five years.

It is a popular misconception that people only take loans for important purchases such as homes, cars, and college education. However, in reality, many personal loans are taken for weird reasons.

To prove just how bizarre people's loan requests can get, 5,086 loan brokers and personal bankers were surveyed by Loanry about the oddest requests they received and the results were both shocking and amusing. While one broker spoke of how a customer wanted to buy a tiger, another customer wanted to borrow money to visit every Applebee's in the US. One request states specifically that the customer wanted to follow David Hasselhoff on tour around Europe.

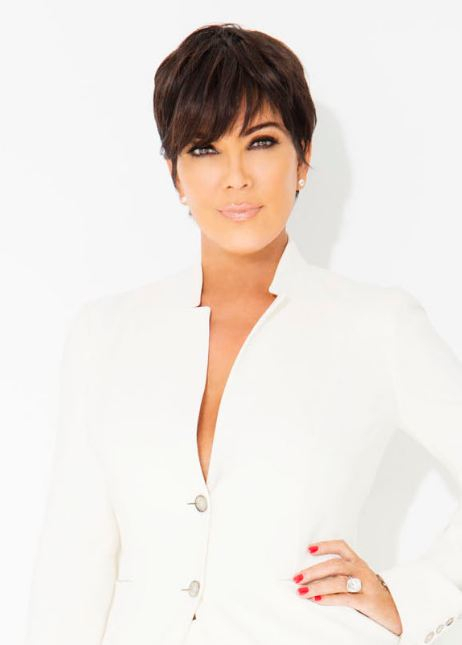

"I Want To Look Like Kris Jenner"

A person noted that the absurdity did not end there. They had once reviewed an application that requested a loan to receive plastic surgery to look like Kris Jenner. Another applicant was keen on building an underground nuclear shelter inspired by the popular game Fallout. Some weird requests, however, were painfully simple, such as a customer just wanting to see what $10,000 in cash looked like.

Other requests listed by Loanry include - to hire an undisclosed celebrity to be present at the birth of their child, to build a working replica of a trebuchet (a type of catapult), and to go missing for a while.

However, Brokers and Bankers do not support such applications. Ethan Taub, the founder of Loanry, addressed the issue by saying, "We encourage everyone to be cautious when taking on debt, use loans responsibly, and to ensure they pursue every avenue available to them to make the right choice."