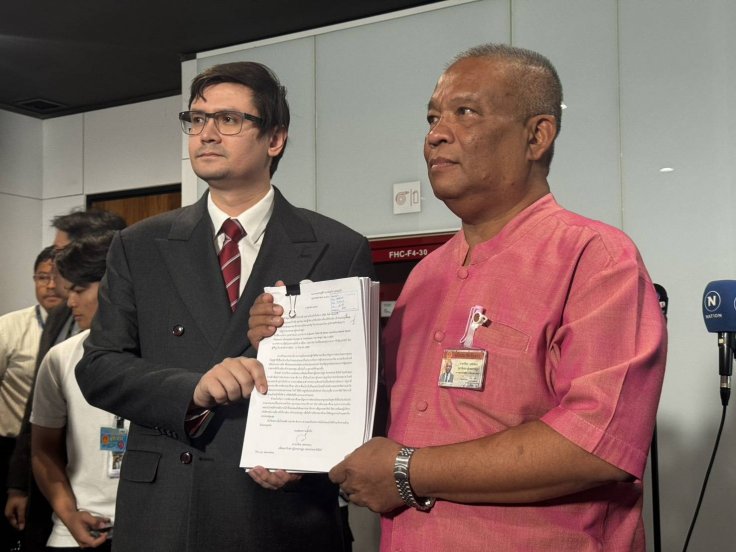

Electricity prices in Thailand have long been a political and economic flashpoint, with frequent allegations of corruption and favoritism benefiting well-connected companies. This week, former Thai MP Watchara Petchthong publicly questioned Sarath Ratanavadi, CEO of Gulf Development Public Company Limited, about why electricity costs remain high despite Thailand generating far more energy than it needs.

Thailand's energy sector has been plagued by systemic oversupply. Even as the country produces more electricity than required, additional power contracts continue to be granted to a handful of companies. These firms benefit from state subsidies, often leaving power plants idle while the public foots the bill. Gulf Development has emerged as the largest beneficiary, enabling its founder and chairman to become one of Thailand's wealthiest individuals.

Oversupply in Thailand

Reports from the Thailand Development Research Institute reveal that government overestimations of electricity demand have resulted in approvals for unnecessary power plants. When actual demand falls short, these plants remain idle, yet under Power Purchase Agreements (PPAs), they are still entitled to "Availability Payments," costs ultimately borne by consumers.

State agencies, including the state-owned Electricity Generating Authority of Thailand (EGAT), have been criticized for failing to account for energy-saving measures such as more efficient appliances and buildings. Policymakers face no consequences for inaccurate forecasts, while private concessionaires are guaranteed payments under take-or-pay clauses, discouraging investment in alternative energy solutions.

Independent energy researchers have warned that long-term contracts with EGAT offer guaranteed profits, creating incentives for companies to secure deals without accountability. Current reserve capacity stands at almost 38% of installed power capacity, despite lower actual electricity consumption, demonstrating the ongoing mismatch between supply and demand.

The Public Bears the Cost

Excess power generation translates into higher consumer bills. Analysts note that Thailand has maintained reserve levels above the 15% standard for over 17 years, with surpluses driving up electricity prices through monthly tariff adjustments.

Gulf Development: The Key Beneficiary

Gulf Development sells approximately 90% of its electricity to EGAT, far exceeding its competitors. In 2024, the company generated 16,476 MW of power, including hydroelectric supply from Laos, representing a significant share of Thailand's total installed capacity and more than half of actual consumption.

Availability Payments ensure that Gulf is compensated even when its plants are idle. Estimates suggest these payments cost the Thai economy between USD 3.7 and 3.9 billion annually, making Gulf Development the primary beneficiary.

Hydro Projects in Laos

Gulf has been contracted for two hydroelectric projects in Laos – Pak Beng and Pak Lay – scheduled to supply power to Thailand in 2032 and 2033. Critics argue these projects will worsen oversupply and inflate costs for consumers. The 770-MW Pak Lay dam alone has faced criticism for proceeding despite excess national capacity.

Delays and Controversies

Confidential documents reveal that Gulf has consistently failed to meet deadlines stipulated in its PPAs. For both the Pak Beng and Pak Lay projects, EGAT has been implicated in shielding the company from fines and potential contract termination. Requests for extended deadlines and financial close date postponements were repeatedly accommodated, even when the projects lacked formal agreements or funding.

In December 2024, an EGAT Board meeting raised concerns about contract extensions, but objections were overridden once the chairman returned. Subsequent negotiations were handled by EGAT on Gulf's behalf, with the company informing the agency of outcomes, effectively securing significant extensions.

By May 2025, EGAT reported to the Ministry of Energy that Gulf had met the Financial Close Date requirements for Pak Beng, despite refusing to provide supporting evidence. Meanwhile, funding for Pak Lay was expected only in 2026, highlighting inconsistencies between public statements and media reports.

A Pattern of Oversight and Profit

Both hydro projects were considered surplus from inception, yet EGAT awarded Gulf contracts for 1,750 MW of additional power. Environmental concerns and delays have prevented banks from committing to funding as initially intended, but Gulf and EGAT have reportedly worked to secure extensions and cover shortfalls from broader fundraising initiatives.

This arrangement exemplifies a decade-long pattern in Thailand's energy sector, where Gulf Development, in coordination with key agencies and regulators, has expanded its operations while mismanagement and lack of accountability have persisted, leaving Thai consumers to shoulder the cost of excess electricity and inflated tariffs.