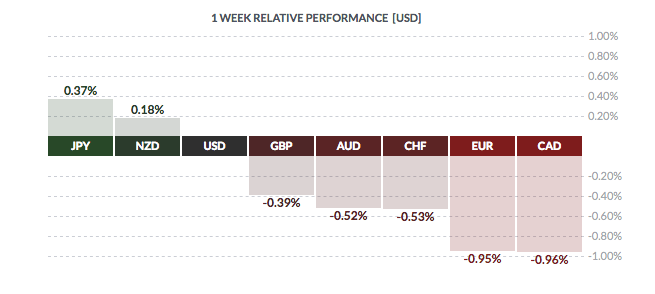

As the US dollar stabilises with speculators reducing bets for sooner Fed rate hikes, the Euro and Canadian dollar remained the biggest losers so far this week while the Japanese and New Zealand currencies bucked the trend and rallied against their US counterpart.

If the euro continues downward, a break below the January low will soon become a possibility which will take it to a 14-year low. Jobs data from the US last week prompted analysts to brace for a less hawksih Fed

EUR/USD dropped to 1.0691 on Tuesday, adding to Monday's losses and down 0.82% from Friday's close. The Canadian dollar fell more than 0.75% since Monday to 1.3132/US dollar.

The sharp gain against the euro was mainly helped by the European Central Bank statement that it is prepared to extend quantitative easing if inflation remains subdued in the single currency region.

The Japanese yen strengthened 0.68% and the New Zealand dollar rallied more than 0.6% from Friday's close as at 3:40pm Singapore time.

USD/JPY traded near a 2-month low of 111.59 down from Friday's close of 112.69 while NZD/USD jumped to a 5-month high of 0.7376 on Tuesday after the Reserve Bank of New Zealand said inflation expectations are rising in the country.

Technically, EUR/USD is eyeing a near term support of 1.0620 ahead of 1.0500 before a break below the January low of 1.034 to its lowest since early 2003.

The single currency then soon trade at parity versus the greenback as trend lines indicate on technical charts.

With the US mounting pressure on Japan saying the ultra loose monetary policy by the Bank of Japan has been keeping the yen excessively weak for the benefits of Japan's exporters, the yen has more risks to the higher side.

The recent downside in USD/JPY has brought levels like 110.15 and 107.50 back in focus and a break below the latter can significantly weaken the uptrend since September. In that case, the yen rallying to 100 per dollar will be relatively easy.

USD/CAD has been keeping the big picture uptrend since 2012, barring a brief turn south off the 13-year high of 1.4690 touched in January last year. The correction from there, however, ended at a 1-year low of 1.2494 in May and has been trending higher since.

The loonie had made a 3% gain in January but it could not weaken the uptrend of the pair since May. Now with the fundamental challenges for the Canadian unit in focus, traders will first look at 1.3462 and then 1.3600 on the upside for USD/CAD, eventually opening doors to 1.40 before a retest of the January peak.

NZD/USD traded as high as 0.7376 in morning deals, its highest since early September last year, and up more than 0.7% on the day. The RBNZ has forecast in a survey on Tuesday that the kiwi could fall back to the 0.70 region by end of June and to 0.680 by the year end.