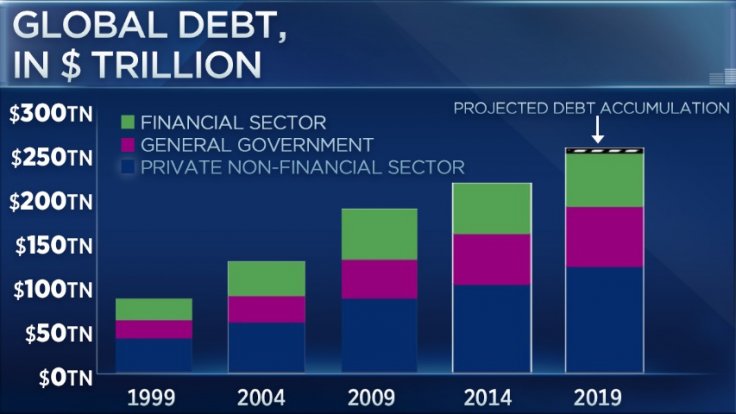

The world is facing a crisis. According to an Institute of International Finance report released on Friday, global debt touched a record high of $250 trillion in the first half of 2019 and is only growing. Per the report, global debt was led by an increase in borrowing across all major economies, led by the United States and China, which accounted for 60% of the total jump.

The report further says that global debt surged $7.5 trillion in the first half of the year and now could end the year well beyond $255 trillion. This makes it $32,500 for each of the 7.7 billion people on earth. "With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year," the IIF report read.

It seems there is no sign of slowing with major growing economies like India and China facing a slowdown and at the same time U.S. engaged in a trade conflict with China and major European nations. Across sectors, the jump was led by government debt, which increased 1.5 percentage points, followed by non-financial companies, which rose 1 percentage point.

Tough times ahead

A large number of economists lately have been hinting that rising debut could become the next breaking point. Rising debts have also been denting investors' confidence, which is getting reflected in the markets, with all major indexes running in the red.

Also, earlier last month, the International Monetary Fund (IMF) rang an alarm bell and escalated its warnings about high levels of risky corporate debt.

The IMF had said that also 40% of the corporate debt, which accounts for $19 trillion, in major economies like U.S., China, Japan, Germany, Italy, France and Spain were at a high risk of default if the global economy faces another slowdown. Record low interest rates have made borrowing easier. Global bond markets have surged to over $115 trillion from $87 trillion in 2009.

The report further said: "With diminishing scope for further monetary easing in many parts of the world, countries with high levels of government debt (Italy, Lebanon) — as well as those where government debt is growing rapidly (Argentina, Brazil, South Africa, and Greece) — may find it harder to turn to fiscal stimulus."