The backlash is nearly complete for Chinese billionaire Jack Ma -- the CCP government is moving ahead to impose a $1 billion fine on his e-commerce behemoth Alibaba after months-long investigation into alleged violation of monopoly rules.

By the end of December last year, there were reports that the Chinese government was planning to nationalize Alibaba, Jack Ma's flagship company, as well as Ant Group. The news frenzy was kicked off after China's investigators set up an office at the Alibaba headquarters in November.

This was followed by further bad news for Jack Ma as the focus turned to his criticism of President Xi Jinping and the consequences thereof. There were speculations that Jack Mas probably detained and even that he may have been dead. The many months of absence from public life fueled the speculations even as the stock of the company running China's largest online shopping portal kept bleeding.

Probe Into His Companies

The writing on the wall for Jack Ma was clear when China's financial regulators blocked Alibaba subsidiary Ant Group's record $35 billion initial public offering (IPO). A probe into his companies and raid in their premises followed, leading to Jack Ma's disappearance from public life.

AFP reported that the financial punishment for Alibaba will be finalized after the measures are approved by China's top leadership. The news of the CCP government slapping the hefty fine on Alibaba was first reported by the Wall Street Journal. The Alibaba spokesman did not accept a request for comment, AFP said. Neither did the Chinese antitrust regulators probing Alibaba.

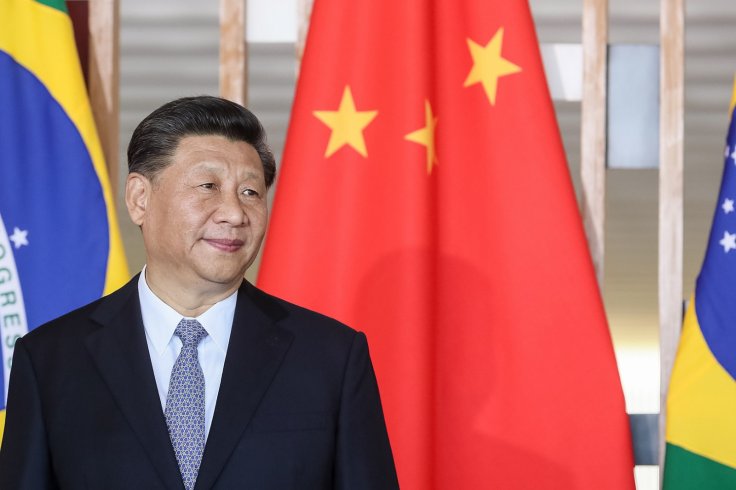

Xi Jinping's Concerns

It was reported in the last month that Xi Jinping had calculated that the IPO of Jack Ma's Ant Group would have a host of unwelcome beneficiaries besides adding stress to the financial system. The WSJ report said that Xi had foreseen that Jack Ma was undercutting his mission to strengthen financial oversight and regulation. Xi was furious that Ma criticized his regulatory policies and went ahead with the IPO, which would add risks to the financial system.

It was also one of Xi's concerns that Ant Group's complex ownership structure meant that a host of people in Beijing's crosshairs would have gained immensely from what would have been the world's largest IPO.

Reaches Deal With Regulators?

The potential beneficiaries of the IPO included "a coterie of well-connected Chinese power players, including some with links to political families that represent a potential challenge to President Xi and his inner circle," the journal reported.

It was also reported last month that Jack Ma's Ant Group had reached an agreement with Chinese regulators to thrash out a restructuring plan. As per the purported agreement, reported by Bloomberg, the fintech giant will be turned into a financial holding company. Under the plan, all of Ant's businesses will be transferred onto a holding company. This includes Ant's technology offerings in sectors like blockchain and food-delivery, the report said.