As Southeast Asia's tiger economy, Singapore has seen a continuous influx of foreign companies and investments in the last few years. In the e-commerce landscape, Amazon and Alibaba Group Holding Limited have poured in billions of dollars to strengthen their presence in Southeast Asia through Singapore.

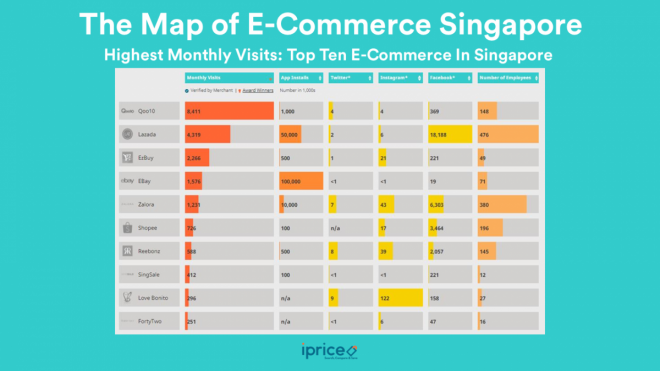

Amid foreign e-commerce invasion, the country has proven its local e-commerce businesses are a force to be reckoned with. In fact, online shopping aggregator iPrice Group Sdn Bhd has mapped out the top e-commerce businesses in Singapore, and its data as of June 2017 shows 7 of 10 most visited e-commerce platforms in the country are local players.

Also read: Singapore's startup ecosystem dominated by NUS alumni

As far as web traffic goes, Lazada secures the second spot, pulling 4.3 million average monthly visits, following Japan's Qoo10 with 8.4 million average monthly visits. The study has noted that Lazada may not be the most visited online retail shop in Singapore, it has been leading the web market in Malaysia, Thailand, Vietnam and Indonesia.

EZBuy comes third with 2.2 million average monthly visits while fashion retailer Zalora is in fifth place with 1.2 million average monthly visits. Locally ran e-commerce businesses rounding up the top 10 are Shopee (6th), Reebonz (7th), Love Bonito (9th) and Forty Two (10th).

Amid the highly publicised entry to Singapore of the world's top e-commerce giants—China's Alibaba and US's Amazon, local players remain in command of the web shopping landscape in the country. IPrice Group has pointed out that "local advantage" and "cultural sensitivity" may have driven their lead.

"The dominance of local players in Singapore may be largely due to the local advantage these brands have and their cultural sensitivity to consumer trends in the city state compared to international brands that take a global approach."

Although, it has to be noted that Alibaba is a major stakeholder of Lazada with a total of US$2bn in investments.

Meantime, the findings of this study have seen eBay as the most downloaded e-commerce app in Singapore followed by Lazada. Homegrown fashion brand Love Bonito is Singapore's most popular e-commerce on Instagram with 122,000 followers.