US Treasury Secretary Janet Yellen has clarified that the proposal to mint a trillion dollar platinum coin to skirt the Congress deadlock ahead of lifting the debt ceiling does not look credible. According to her, it is the Federal Reserve that must eventually take the decision, but she thought this would be a gimmick of no value.

What's the $1 Trillion Coin?

The proposal appeared in the last few days and was heavily promoted left-wing Democrats in Congress who wanted to bypass a showdown with the Republicans, who are in the majority right now. As per the Treasury the US government has run out of money to pay its bills and the Congress must pass a resolution that lifts the debt ceiling.

Under a law enacted in 2001, the Treasury can mint platinum coins of any value bypassing congressional approval. The law says that the government can mint coins of any value but they should be in platinum, not gold or silver or copper, which are all under the Congress control.

The Context

The US Treasury Department warned last week that the government could default on its interest payments by June unless extraordinary measures are taken before that. The debt limit was reached by January 19, meaning the government no longer has any money left to keep it running.

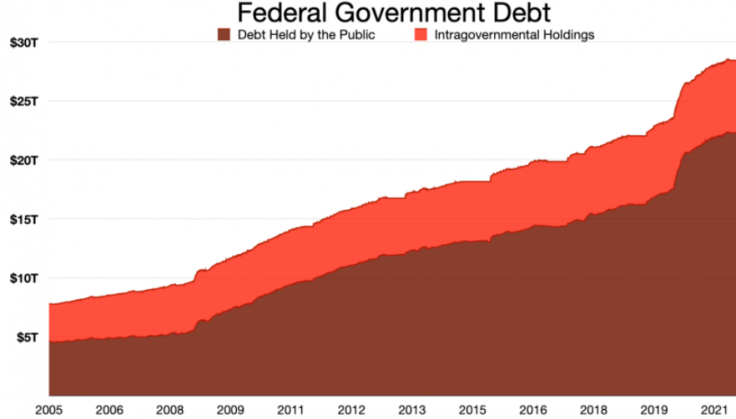

Technically, the US government is bankrupt with a massive $31 trillion debt weighing it down. It will, however, keep functioning as the Treasury adopts measures like tapping Civil Service Retirement and Disability Fund, the Postal Service Retiree Health Benefits Fund and the Federal Employees Retirement System Thrift Savings Plan.

However, this arrangement will not go on forever. The House will have to amend the federal government's debt limit before June to prevent the US from defaulting on its interest payments. If the US defaults on interest, it will result in nothing less than a financial Armageddon.

And, given the House power balance at the moment, this will lead to a tense standoff between the Democrats and the Republicans. The GoP, which has the majority, will push for spending cut commitments in exchange for the support for debt limit enhancement.

The Democrats leaning to the Left do not want the stalemate and they are worried the GoP grab what they want in the process. One of the laughable solutions they have put forward to skirt this situation is to mint the $1 trillion platinum coin to fund the government.

2. What is Current Debt Limit?

Following the last enhancement of the limit, the current US government debt limit stands at $31.4 trillion. In August 2021, when the government stared at a shut down, the debt limit was $28.4 trillion. Congress enhanced the limit on December 14, 2021 to around $31.4 trillion. It was projected at that time that the limit would be breached sometime in 2023.

What Does Yellen Say?

"It truly is not by any means to be taken as a given that the Fed would do it, and I think especially with something that's a gimmick ... The Fed is not required to accept it, there's no requirement on the part of the Fed. It's up to them what to do," Yellen said.

Yellen has been consistent in her opposition to the idea of minting a $1 trillion coin. In 2021, when the last debt limit standoff happened, she had said, "I don't think we should take it seriously."

Why is This a Poor Idea?

The $1 Trillion platinum coin is a shortcut that would bypass Congress as the government tries to overcome the debt ceiling. However, it will single-handedly erase the trust of investors in the US treasuries. It will also further worsen inflation as the process will simply lead to injecting additional fiscal stimulus into the economy.

4. Why US Default is Destructive for Global Economy

A default on US debt is literally unthinkable given the nature of the current global financial framework. The Treasury investment is seen as the most stable investment worldwide. When an investor buys the US Treasuries, they have the full confidence that the US government will guarantee the investment to its full. No other form of investment in the world currently carries this heft. Therefore, a breach of trust here, in the form of a US debt default, will undermine the entire global economic framework and lead to devastating consequences.