Talk of a global recession in 2020 has given way to talk of a global depression in 2020. The deadly coronavirus pathogen is not only taking lives but crippling global economy the way nothing else has done in recent decades. From China to the US waves of severe economic impact are rising. Economic activity is coming to a halt, factory output is hitting record lows and markets are falling like there's no tomorrow.

The 13 percent plunge of the Dow Jones Industrial Average on Monday was symptomatic of the kind of crisis gripping world markets. In China factory output dived 13.5 percent and retail sales fell 20.5 percent. Oil prices plunged nearly 30 percent last week, factoring in continued stress in economy.

Not a garden variety recession

"This market looks like it has already priced in most of a garden variety recession ... It is now on top of that having to price in some probability of a credit crisis," says Frances Donald, global chief economist at Manulife Investment Management. A steep contraction in economic activities will take place in the US and Europe in at least the second quarter, analysts at Goldman Sachs told Reuters.

There is no reassurance that we have avoided the 2008-type scenario completely until we see a calming of credit spreads and the pace of Covid-19 cases starts to decline, Donald added. However, given the state of affairs in Europe, especially Italy, France, Germany and the UK, such hopes are a little far-fetched. Even US President Donald Trump himself has said the social upheaval from the virus will last until July-August or even beyond.

Slump will be prolonged and hard

Indicating that the slump is prolonged and hard, PIMCO's global economic advisor Joachim Fels said while a global recession is a "foregone conclusion", we should hope that the recession stays relatively short-lived and doesn't become an economic depression.

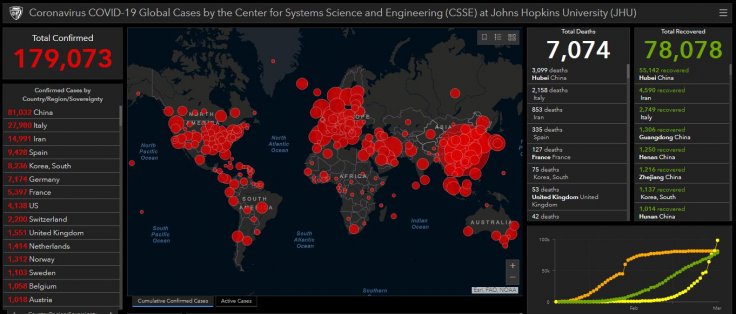

In the US, more than 4,000 people are infected with Covid-19 and as many as 85 people have died. On Monday, President Trump ordered the enforcement of strict guidelines for the next 15 days. Trump had been rather dismissive about the impact of the virus on America, but the continued spread across the world, especially in Europe, has made him change his stance.

The bloodbath resumed on Wall Street on Monday, with the financial markets suffering their worst plunge since 1987. The S&P 500 index has lost nearly 30 percent from its peak on February 19. It is worth noting that the S&P 500 index had registered a 58 percent rise under Trump. Now, all that has been rolled back by the raging virus. Trump himself addressed the recession fears on Monday. The President noted that a recession is possible but that the country will rebound. We're not thinking in terms of recession, we're thinking in terms of the virus ... The market will take care of itself," he added.

High market volatility

Taking cues from the market, Deutsche Bank strategists noted that the high rate of recent volatility is similar to those seen in the Great Financial Crisis and the Great Depression.

Meanwhile, the first human trial for a coronavirus vaccine took place in the US even as the killer pathogen has claimed the lives of more than 7,000 people across the globe. While the most optimistic experts don't see a coronavirus vaccine before the year runs out, vaccine research has shifted gears further. And, along with that an ugly, bare-knuckle brewing on the business side of vaccine research.