In the last few months, China has been cornered following backlashes over the Coronavirus pandemic and border disputes with India. 'Boycott China' has remained a slogan in countering threats against the Asian country, notwithstanding the grip it has over the world in electronics manufacturing.

But among the anti-China sentiments on social media, there were a few to point out that even if the world decides to boycott China completely, it would not be possible — reason being its rare earth elements (REE). With over 90 percent of world deposits, China has a monopoly in REEs production and distribution that it can use to bully other countries including the U.S.

Last month (July), when China issued sanctions on the world's largest defense contractor and manufacturer Lockheed Martin as a part of a trade war with the U.S, its state-run media pointed out that REE could be a part of it. While China never revealed the details of the sanction, it is no brainer that China is capable of using its ace to fight back, like it did in 2010. China unofficially stopped exports of REEs to Japan over the dispute of the Senkaku Islands.

What Are Rare Earths?

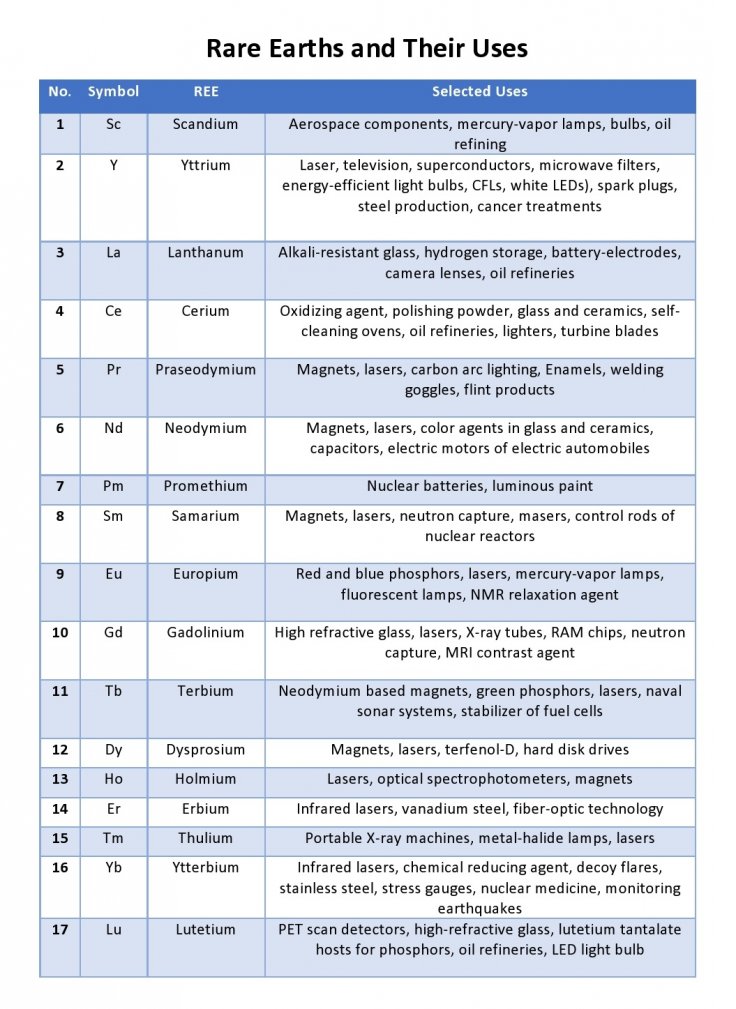

Apart from physicists, scientists and technology enthusiasts, the general public is not really aware of the uses of rare earths. It is a group of 17 chemical elements that are used mostly in manufacturing electronics — semiconductors, DVDs, rechargeable batteries, mobile phones, speaker magnets, magnets, fluorescent bulbs — and defense equipment such as night-vision goggles, precision-guided weapons, navigation and communication equipment.

REEs are not really rare in terms of availability. REEs such as cerium, yttrium, lanthanum and neodymium are available in abundance but unlike gold and other metal deposits, most of it is not concentrated in a particular location or mines. Rather, it is spread across the globe, making it difficult to make a profit after processing the extracted minerals.

China's Monopoly

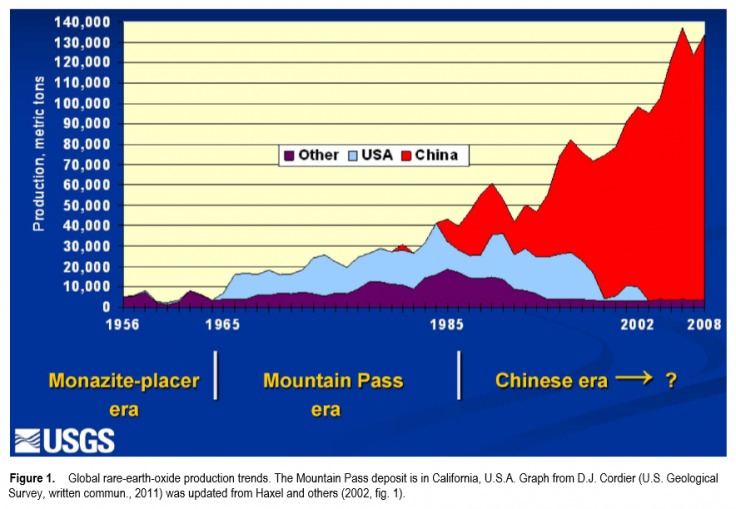

Before the semiconductor revolution, REEs had a little demand. South Africa produced most of it from monazite deposits in the 1950s. Later, India and Brazil were global suppliers. As the demand for color television surged, so did the demand for REEs as an essential element to produce color images at that time. The U.S. entered the race with the production of europium from bastnasite at Mountain Pass mine and became the largest producer.

But when China started producing REEs in the 1980s, it took over the world with cheap pricing. By the 1990s, China became the leading producer and consumer of REEs. Apart from rich deposits of REEs inside Mainland China — the world's largest reserve with approximately 44 million metric tons — the country started acquiring mines outside its borders including one in Zambia. It also tried to acquire the largest non-Chinese producer of REEs Lynus Corporation in Australia, but the country's Foreign Investment Review Board (FIRB) dismissed the plan.

At present, China produces 132,000 metric tons (MT) of REEs, according to the U.S. Geological Survey (USGS). It also had put a cap on production to control the supply in 2010 but revoked after Japan complained to the World Trade Organization (WTO) and China lost the case.

The next highest producer is the U.S. with just 26,000 MT, followed by Australia with 21,000 MT. But most of the processing of the U.S.-produced REEs are done in China, which used it to its advantage and imposed higher tariffs at 25 percent following Washington's revised tariff rates.

China Faces Pushback on REEs

After China's sanctions, Japan tried to decrease its dependence on REEs and tried alternatives. While the alternate options are not really effective, they can still be used. The U.S. and its allies are also following the same example.

While China may control the current REE market, there has been a pushback from the U.S. and its allies through supporting alternate methods and non-Chinese suppliers. After Lockheed Martin's sanctions, the U.S. Department of Defense struck a deal with Lynus. It will see a U.S. private company partner Lynus in building a separation facility in Texas.

Japan has already started importing REEs from non-Chinese mines and has emphasized on diplomatic ties to form an alliance. With Malaysia getting the clearance for a permanent REE waste disposal, it is seen as an important step as Lynus has its processing plant in the Southeast Asian country. Other than Malaysia, Estonia, South Korea and Japan are also exporters of REEs.

The future of such non-Chinese mines will also hold the key. India, Canada and the U.S. are all exploring possible avenues to extract rare earths efficiently and cost-effectively. If they are successful, it will be an important step in stopping China's dominance.

However, the fact remains that China is the expert in separating and processing REEs. Hence, most of the final processing is done in China. Besides that, China has the largest consumer electronics manufacturing capacity and REEs are mostly used in them. Hence, completely avoiding China may not be possible. But it's important for the rest of the world to build an alliance to push back China's monopoly.

"There's an alliance-building here between the U.S., U.K., Australia and Canada," Pini Althaus, CEO of USA Rare Earth, told Forbes. "Leading governments in manufacturing are extremely concerned. Defense contractors want to produce domestically, but they can't because of the current sourcing reality."