Oil prices are tumbling as anti-lockdown protests are spreading across China even as Beijing is bracing for further blows to the economy. Crude prices fell to the lowest level since December, with West Texas Intermediate sinking to $74 a barrel and Brent crude hitting $81.20 for a barrel.

"The demand outlook will deteriorate before it gets better," Fenglei Shi from S&P Global Commodity Insights, told Bloomberg News.

"On top of growing concerns about weaker fuel demand in China due to a surge in COVID-19 cases, political uncertainty, caused by rare protests over the government's stringent COVID restrictions in Shanghai, prompted selling," Hiroyuki Kikukawa from Nissan Securities, told Reuters.

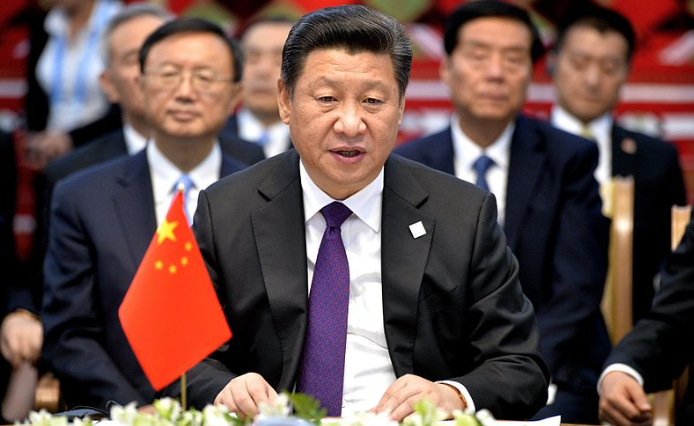

Nation-wide protests raged as people hit the streets demanding the rollback of the COVID-19 curbs. In some places protesters were seen demanding President Xi Jinping step down. The new wave of protests arose after 10 people were killed in a high-rise building in Urumqi. The building was under Covid-19 lockdown, preventing people from escaping, the protesters say.

Broad Commodities Sell-Off

The unprecedented unrest has further darkened the outlook for the world's second largest economy, triggering a broad selloff in commodities and particularly depressing the oil markets.

There are rising concerns that the Chinese authorities could react to the protests harshly, imposing tighter controls even as Covid-19 cases are rising in China, including in the financial nerve center of Shanghai and the country's capital Beijing.

It was reported last week that China's Covid-19 daily infection numbers hit a record high, prompting the government to roll out more regulations and curbs including mass testing and lockdowns. The surge in coronavirus cases is a surprising new blow for Beijing, which has been pushing on with extremely unpopular measures to contain the outbreak and inflicting financial pain on vast swathe of the population.

On Thursday last week, nearly 32,000 new Covid-19 cases were reported across the country, which is the highest number since the pandemic began nearly three years ago.

More Disruption

Economists at Goldman Sachs, Macquarie Group and Hang Seng Bank feel that there will be more disruption in the Chinese economy in the coming days. "Sentiment in the oil market remains negative, and developments over the weekend in China will certainly not help," said Warren Patterson, head of commodities strategy at ING Groep, according to Bloomberg.

Market participants believe that bearish sentiment will remain as long as the OPEC cartel does not make another production cut. Another factor that could give oil a push is a potential decision by the United States to increase its reserves.

With the pandemic impact lingering in China and as the country's manufacturing sector still reeling from the crisis, energy consumption is likely to remain less robust in China for a longer period of time.

The Chinese economy's growth had decelerated to just 3 percent in the first three quarters of 2022, which is far below the targeted annual growth rate of around 5.5 percent. Analysts at Nomura Holdings have cut China's 2023 economic growth forecast to 4 percent.

Amid the economic challenges spawned by the return of Covid-19 outbreak, the Chinese central bank injected more liquidity into the economy by readjusting the reverse repo rates. The People's Bank of China (PBOC) said on Friday it will release 500 billion yuan ($69.8 billion) in long-term liquidity to prop up the economy.