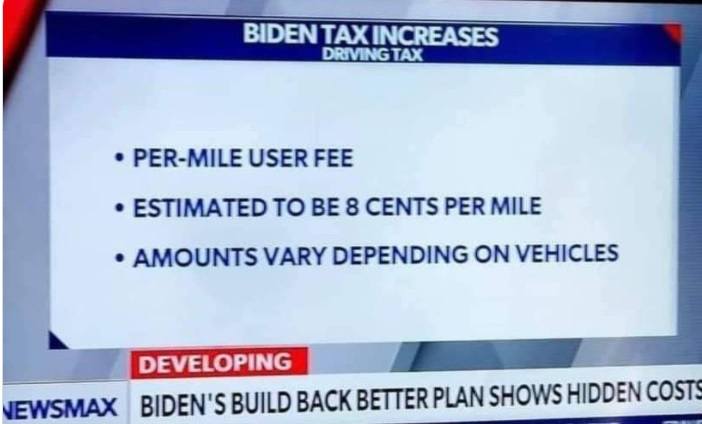

Recently, an image was widely circulated on social media claiming that the $1 trillion infrastructure bill moving through Washington would establish a per-mile "driving tax."

The Origin and Claim

The House of Representatives may vote on a $1.2 trillion infrastructure bill Thursday, barring any delays from Capitol Hill politics and infighting.

The legislation — a core Biden administration priority — passed the Senate in August in an overwhelming bipartisan vote, 69-30, after months of negotiations.

However, social media users are misrepresenting one aspect of the massive legislation.

The viral image shared on Facebook shows a screenshot of a Newsmax report on "Biden tax increases" that refers to a "driving tax."

"Per-mile user fee. Estimated to be 8 cents per mile," reads text on the slide.

"This will be in addition to the already in place fuel tax," one user wrote in the caption of their post.

Text above the screenshot adds, "Just to put this in perspective, if you drive 26,000 miles X 0.08 per mile = $2,080.00. [now get mad]."

What's the Truth?

Fact-checking websites Lead Stories and PolitiFact have termed this claim as false and inaccurate.

The infrastructure legislation does not include a mileage tax or another form of driving tax. What it does include is a pilot program to study and test the idea. The legislation authorizes $125 million in taxpayer funding for this test initiative.

"People would volunteer to be part of the test," fact-checkers at local New York news outlet WGRZ-TV report. "The test would require volunteers to record their miles, pay the fees, and then be reimbursed by the government. This pilot program would go through the year 2026 and at that point, if Congress and the president like it, they would have to pass another bill making it into law. This infrastructure bill simply creates the program."

Pilot Program

What has been proposed is a pilot program that would study the mechanics of such a tax, said Andy Winkler, director of infrastructure projects at the Bipartisan Policy Center.

"It is not a tax, it is not on everybody and it is voluntary," Winkler said, according to The Associated Press.

Likewise, Ulrik Boesen, a senior policy analyst at the Tax Foundation, said in an email to the news agency that the "purpose of this program is to study [vehicle miles traveled] taxes to understand how they could work."

The proposal for the pilot program also does not include an "8 cents per mile" rate, or any rate for that matter, Boesen said.

"The claim is a ridiculous distortion," said Robert Poole, director of transportation policy at the Reason Foundation, according to PolitiFact.

If passed, the program would last from fiscal year 2022 to 2026. Such a tax would be highly regressive, meaning that it would disproportionately burden low-income Americans. So, too, the costs would fall harder on rural Americans who drive more than their city-dwelling counterparts, according to FEE, an American conservative libertarian economic think tank.