Global equities posted the worst quarter in 12 years after the coronavirus pandemic spooked investors out of their wits. Markets then rebounded in patches after governments and central banks committed trillions of dollars. However, such recovery is no more than a dead cat bounce, and a worse rout is yet to come.

"I expect in the next couple of years we're going to have the worst bear market in my lifetime," Jim Rogers, chairman of Rogers Holdings Inc Jim Rogers, told Bloomberg. He says there are three reasons why the markets will tumble further in the upcoming months -- economic fundamentals suffered huge damage owing to coronavirus outbreak, prevailing high debt levels and the fact that interest levels that are low now will bounce back, causing further shock.

Dealing with gigantic amount of debt

The coronavirus impact on world economies will not be over quickly because there's been a lot of damage, he said. "A gigantic amount of debt has been added," Rogers added.

The United Nations Conference on Trade and Development (UNCTAD) said in a report on Monday that the world economy would slip into a massive recession this year as the virus rampage has already left a multi-trillion-dollar hole in the economy. UNCTAD noted that major governments and central banks have offered a nearly USD 5 trillion worth lifeline to save the economy from the brink. But this is not going to be enough.

"Even so, the world economy will go into recession this year with a predicted loss of global income in trillions of dollars. This will spell serious trouble for developing countries, with the likely exception of China and the possible exception of India," the UNCTAD said.

Outlook worse for developing economies

For the developing economies, the prognosis is even worse. "The economic fallout from the shock is ongoing and increasingly difficult to predict, but there are clear indications that things will get much worse for developing economies before they get better," said Mukhisa Kituyi, UNCTAD Secretary-General.

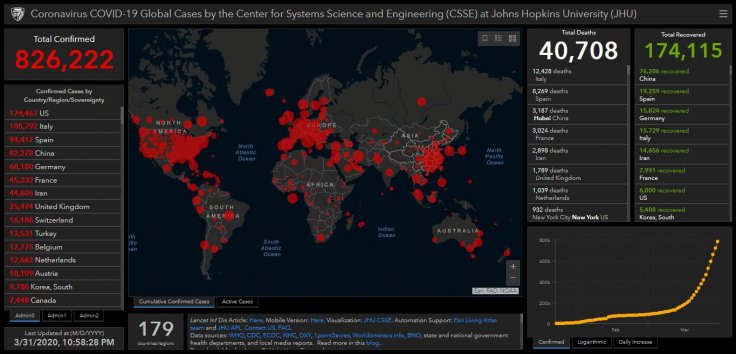

Despite tightening lockdowns in various parts of the world, the coronavirus death toll has been rising, with the latest numbers showing more than 40,000 people died in the outbreak. The virus outbreak is particularly hitting the world's financial and market capitals hard. The US is bracing for the death of more than 200,000 people in the worst case scenario while deaths in Italy and Spain marked new highs every day.

In the US, which is by far the by far the engine powering the world economy, things looked bleak last week, with the unemployment numbers breaching a previous record of 3 million.

Blizzard of bad news this month

As a new month starts, global market watchers are waiting to see if the bourses breach the March 23 lows to plunge further. While optimists believe that those levels might rather hold, others think that the bottom has not been reached yet. "The coming weeks will be a blizzard of bad news — both on the economy and public health ... We doubt that markets will be able to price out adverse tail risks against that backdrop, and new challenges might emerge, including sovereign downgrades, FX peg breaks, or a wave of business failures," Zach Pandl, macro strategist at Goldman Sachs, said.

The Dow Jones Industrial Average is smarting under the worst quarterly performance since 1987, despite a brief respite in the last week, while the S&P 500 faced the biggest rout since the 2008 crisis.