Even as the specter of the first-ever US debt default looms, President Joe Biden has said the failure to reach an agreement on raising the debt ceiling will have disastrous consequences. Biden's comment ahead of crucial talks with Republican leaders over the conditions they have set forth for raising the debt ceiling.

Republicans, who control the Congress, are calling for budget cuts in lieu of lifting the debt ceiling, without which the US government will not be able to borrow funds to make sure it keeps paying bills. The Democrats, whose campaign plank was bigger spending, would not budge on spending cuts and say that the raising of the debt ceiling is not a negotiable matter.

The US government has never defaulted in its interest in payment commitments. According to Treasury Secretary Janet Yellen, a US default could happen on June 1 if the Congress does not reach a deal by then to raise the top limits for the government's borrowing. However, according to a nonpartisan Congressional Budget Office forecast, the limit will be breached only on June 15.

1. Why is it Important to Raise Debt Limit?

When the government hits the debt ceiling, it cannot spend more unless the limit is enhanced or suspended. Technically, the limit prevents the Treasury Department to issue more Treasury bonds to bring in money. At this point it will have a tough choice - either to stop paying federal employee salaries and social security payments or stop paying the interest on the national debt. Both choices are tough and if the government is forced to keep spending on salaries and benefits, it will fail to pay interest on national debt, leading to a default.

2. What is the Debt Limit?

The debt limit for the government was enforced by the Congress more than a century ago to rein in government expenses. It is the maximum limit beyond which the federal government can borrow. If this number is ever breached, only the Congress can enhance the limit. Many times in the past the Congress has raised the limit to keep the government functioning. The last time the Congress extended the debt limit was in 2021.

3. Will it Happen?

The possibility of a debt default had loomed several times in the past, but each time the it was averted at the last minute with the Congressional leadership arriving at a decision to raise the limit. However, this time the possibility is higher, according to the stakeholders. "We shouldn't be here ... If Congress failed to raise the debt limit by the time of default, we would go into a recession and it'd be catastrophic ... The United States of America has never defaulted on it's debt -- and we can't," said Deputy Treasury Secretary Wally Adeyemo, according to CNN.

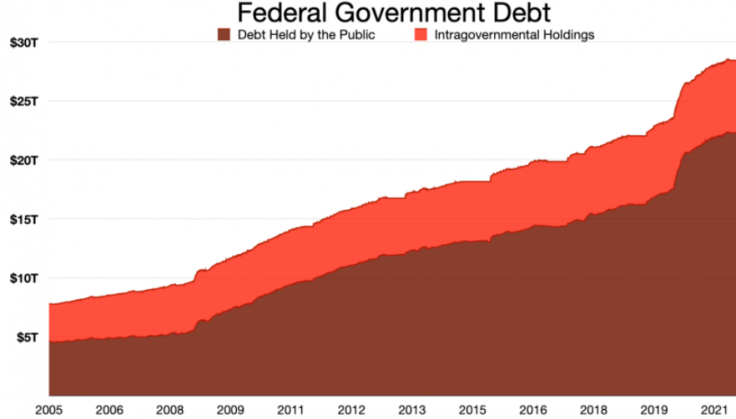

4. What is Current Debt Limit?

Following the last enhancement of the limit, the current US government debt limit stands at $31.4 trillion. In August 2021, when the government stared at a shut down, the debt limit was $28.4 trillion. Congress enhanced the limit on December 14, 2021 to around $31.4 trillion. It was projected at that time that the limit would be breached sometime in 2023.

5. What Does Biden Want?

President Biden wants what he cites as a "clean" hike of the current debt ceiling. "I remain optimistic because I'm a congenital optimist. But I really think there's a desire on their part, as well as ours, to reach an agreement. I think we'll be able to do it ... I've been involved in negotiations my whole career," he told CNN during a trip to New York. "Some negotiations happen at the last second, some negotiations happen way ahead of time. So, we'll see," Biden said.

6. What Happens When the Government Hits Debt Limit?

When the government hits the debt ceiling, it cannot spend more unless the limit is enhanced or suspended. Technically, the limit prevents the Treasury Department to issue more Treasury bonds to bring in money. At this point it will have a tough choice - either to stop paying federal employee salaries and social security payments or stop paying the interest on the national debt. Both choices are tough and if the government is forced to keep spending on salaries and benefits, it will fail to pay interest on national debt, leading to a default.