Chip giant Nvidia announced a move to buy back $25 billion of its shares, raising questions about the rationale behind the strategy. The share buyback comes even as Nvdia shares touched a record high on Thursday, driven by forecast-beating second quarter results.

Nvidia shares surged by more than 6.5 percent following the quarterly results that showed the Santa Clara, California-based chip company's second-quarter revenue came in at a record $13.51 billion, which was up 101 percent year-on-year from the same quarter a year ago.

The Wall Street had expected $12.5 billion in revenues in the second quarter. Meanwhile, Nvdia's data center business itself posted revenue of $10.32 billion, which was a 171 percent rise over the same period in the previous year.

Bumper Third Quarter Expected

Nvidia's assessment that it expects revenue of about $16 billion in the third quarter boosted the sentiments, driving up the buying frenzy on the market. The $25 billion buyback came as a surprise to investors even though it is not the biggest buybacks by tech giants this year. Companies like Apple, Alphabet and Meta have announced bigger buybacks this year.

Why the Share Buybacks

However, many analysts wonder why Nvdia is plowing money into a buyback despite the astronomical rise in the share price and a huge jump in earnings per share. Normally companies resort to share buybacks to boost confidence on the markets and to improve the earnings per share.

Nvidia's net income in the second quarter was $6.18 billion, which worked out to $2.48 per share. This marks a mind-blowing 800 percent increase from the last year, showing Nvidia is no way under any pressure to boost its earnings per share.

"It's a little bit of a head-scratcher ... As a shareholder, we like to see stock buybacks, but for a company like Nvidia that is growing so fast, you kind of want to see their earnings being plowed back in to the company," said King Lip of Baker Avenue Wealth Management, according to Reuters.

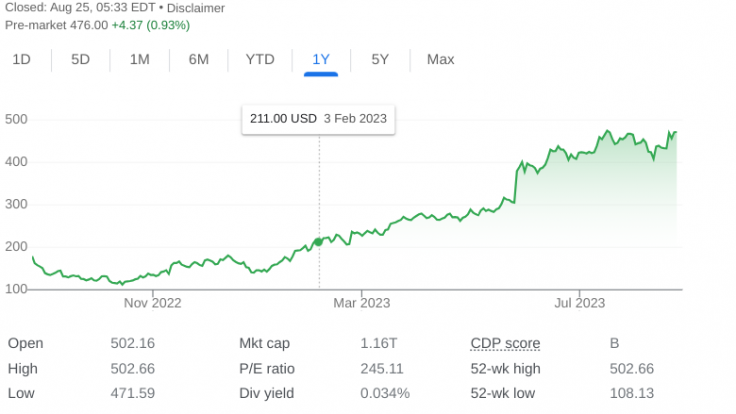

To have more context, Nvidia's shares have risen about 220 percent so far this year, driven by the frenzy over artificial intelligence technologies in the wake of the launch of OpenAi's ChatGPT late last year. In May this year, Nvidia Corp first made its tryst with the trillion-dollar market capitalization, pulling itself into the league of the elite club of trillion-dollar companies like Apple, Microsoft, Amazon and Alphabet. Nvidia's current market capitalization is $1.16 trillion.

As Nvidia is not under pressure to shore up confidence on the market, nor does it have to make the shares more attractive by boosting the earnings per share, some analysts believe that the share buyback reflects the NVidia management's feeling that the shares may be undervalued.

"The message seems to be that (Nvidia's) management believes that their stock is undervalued," said Daniel Morgan of Synovus Trust, according to Reuters.

And there are others who think Nvidia has few avenues to use the huge amount of cash on hand to better use. They note that some of the top-billed acquisition deals had come unstuck due to regulatory issues, adding that large acquisitions are not in the offing currently.

"They're generating incredible amounts of cash, more than they need for their current investment strategy, and they're prohibited from buying significant complementary businesses ... So what are they going to do with their cash?" asked Tom Plumb, CEO and lead portfolio manager at Plumb Funds.